Status update: VAT reduction as part of the economic stimulus package and

The German government's future package – and what this means for the system

SAP Business One means

We have presented SAP's recommendations for preparing for the reduction in VAT as part of the German Federal Government's 2020 economic stimulus and future-oriented package in the familiar style of our training materials and supported them with screenshots.

Please note that the Federal Council, as of today, A special meeting regarding this package has only been convened for June 29, 2020. A final decision will be made there. with regard to the Federal Government's economic stimulus and future-oriented package, also with regard to its implementation, expected. https://www.bundesrat.de/SharedDocs/pm/2020/010.html

SAP currently only provides manual recommendations for action. The release of a patch or automated procedures to support the tax change is not currently planned.

All recommendations for action listed in the document below refer to the official communication of the Federal Government at the time of its preparation. The document contains information for the system-side implementation of the effects of the German government's economic stimulus package within SAP Business One.

Tax law issues concerning the implementation of these requirements are not addressed in this document and must be clarified with your tax advisor. We strongly recommend involving your tax advisor in the implementation process!

We would be happy to assist you with implementing these adjustments upon request. It is recommended that you create the planned changes in your test system and test them there.

Reduction of value added tax as part of the economic stimulus package and

The German government's future package – and what this means for the system

SAP Business One means

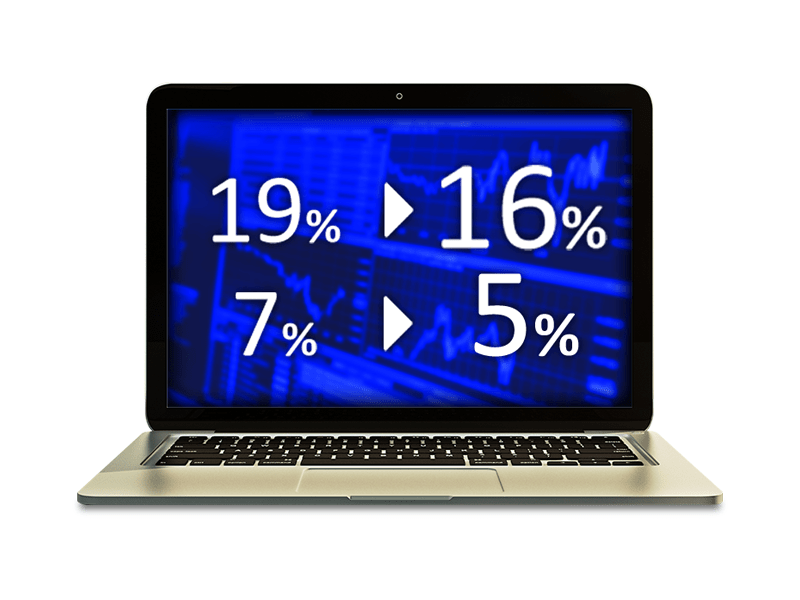

Last week, the German government approved a coronavirus economic stimulus package, which includes, among other things, a reduction in value-added tax (VAT) from 19 to 16 percent and from 7 to 5 percent. This reduction will be in effect from July 1st to December 31st, 2020.

Changes must be made in SAP Business One for the period of the VAT reduction.

SAP Germany is currently gathering the available information and assessing the system-related impact.

SAP Germany currently assumes that the necessary changes can be made without installing a patch.

We will inform you as soon as the system-related impacts are clearly defined.