Mandatory e-invoicing from 2025: What you need to know now

no worriesYou're not alone: The fact that e-invoicing will become mandatory starting in 2025 is causing stress for many. Large and small companies alike are affected by the introduction of e-invoicing.

With the commitment, to create and receive electronic invoices, a fundamental change is coming to the B2B world.

In this article We answer the most frequently asked questions about e-invoicing to help you to orient oneself and thus make the transition easier for you.

Here are the most important points in advance:

Here are the most important points in advance:

- With the 1 January 2025, e-invoicing will be mandatoryThis applies to all invoices that between companies (B2B) take place and are over 250 euros.

- For the Send There are transitional periods for electronic invoices.

- The Received of e-invoices is from 1 January 2025 without exception and mandatory without a transition period.

- Tip: You can read e-invoices free of charge and without registration with this online viewer.

2. Who will be subject to the e-invoicing obligation from 2025 onwards?

3. When will e-invoicing become mandatory?

4. Are there any transition periods?

6. Are there any differences between an e-invoice and a PDF invoice?

7. What does an e-invoice look like?

8. How can I read an e-invoice?

9. E-Invoicing Program: Which software or tool do I need for e-invoices?

10. What e-invoice formats are there?

11. How do I switch to e-invoicing?

12. What are the advantages of e-invoicing?

13. How does e-invoicing work?

14. What legal requirements apply to e-invoicing?

1. What is an e-invoice? An e-invoice (electronic invoice, also called e-invoice or e-invoicing) is an invoice that is created and transmitted in a machine-readable format (See point 7: What does an e-invoice look likeImportant: A PDF, an Excel file, or, for example, a JPG image of a paper invoice are not e-invoices. While these are digital files, an e-invoice must be created in a specific format so that the invoice can be processed by software programs. While it is possible to have a tool read a PDF, this is error-prone. The most important features of an e-invoice are:

- It contains so-called structured data, e.g. in the form of an XML file.

- It is fully machine-readable and can therefore be processed by appropriate tools.

- It will be sent via electronic channels.

2. Who will be subject to the e-invoicing obligation from 2025 onwards? The e-invoicing requirement applies to all companies that do business with other companies (B2B). Although there are transitional periods (see point 4: Are there transition periods?), but these only apply to sending the e-invoice. Important:

- Receiving e-invoices: Mandatory without exception and without a transition period from January 1, 2025! Small business owners and the self-employed are also affected.

- Create or send e-invoices: Transitional periods until the end of 2026 and 2027, depending on turnover (see point 4: Are there transition periods?.

E-invoicing is already mandatory for companies participating in tenders or contracts from public institutions. Currently, invoices issued in the B2C (business-to-consumer) sector, i.e., invoices to private individuals, are exempt from this requirement. However, this area could also be regulated in the future.

3. When will e-invoicing become mandatory? The obligation to issue e-invoices will apply from 2025, specifically from January 1, 2025. By then, receiving electronic invoices (e-invoices) will be mandatory for B2B transactions in Germany and many other EU countries. Companies that exchange invoices with other companies must be able to issue them electronically from this date.

4. Are there any transition periods for the introduction of e-invoicing? Yes, there are transition periods. BUT: These only apply to sending e-invoices, not receiving them. This means that, without exception, companies must be able to receive, check, process, and archive e-invoices starting January 1, 2025. The transition periods for sending electronic invoices apply to:

- Companies with a turnover exceeding EUR 800,000 in the previous year until December 31, 2026

- Companies with up to EUR 800,000 previous year's turnover until December 31, 2027

5. Are there any invoices that are exempt from this obligation? Yes, exceptions are:

- Invoices under 250 euros

- Invoices to private individuals (B2C)

- Invoices for services that are tax-free according to Section 4 No. 8–29 UStG

- Tickets

6. Are there any differences between an e-invoice and a PDF invoice? Yes, the difference between an e-invoice and a PDF invoice lies primarily in the structure of the data (See point 7: What does an e-invoice look like?A PDF invoice is a digital copy of a paper invoice and usually has to be processed manually because the data is not machine-readable. While a PDF can be read by software, this can lead to errors because PDFs are not optimized for this. In contrast, an e-invoice contains structured data (e.g., in XML format) that can be automatically read and processed by the software. This enables fully automated processing without manual intervention. A PDF invoice or an Excel file is not an e-invoice!

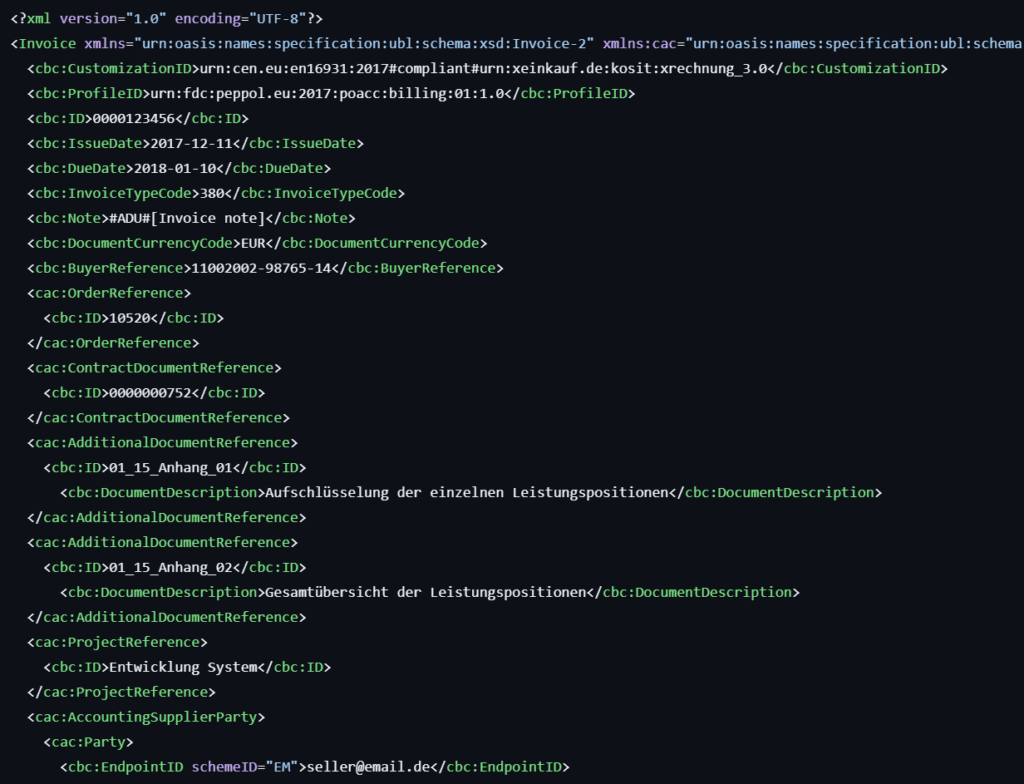

7. What does an e-invoice look like? An e-invoice is an electronic, machine-readable invoice. It contains the same information as a paper or PDF invoice, such as the invoice number, date, amount, etc. The difference is that the data is presented in a so-called structured format so that it can be processed automatically by software. The two common formats are ZUGFeRD or XRechnung. E-invoicing from 2025: This is what an electronic invoice will look like if it is not processed by software.

8. How can I read an e-invoice? If you want to read an e-invoice, you need a suitable tool. There are various solutions for both small and large companies. Learn more at further downIf you are looking for a quick solution that allows you to read e-invoices immediately, free online viewers It is important that your data is not saved by the viewer. We can this viewer recommend which is both free and does not require data storage and registration.

9. E-invoicing program: Which software or tool do I need for e-invoices? To create, send, and receive e-invoices, companies require suitable software solutions. There are various programs available that are suitable for both small and large companies. Ideally, the solution is integrated into an ERP system to avoid the need for additional tools. ERP and accounting software Many modern ERP (Enterprise Resource Planning) systems and accounting programs now offer integrated functions for creating and processing e-invoices. Popular providers such as SAP, Microsoft Dynamics, DATEV, and Lexware have already developed modules that support e-invoicing requirements. Electronic invoices for small businesses can, for example, be processed via an ERP system such as SAP Business One For solo self-employed individuals, Fastbill could be a good solution.

10. What e-invoice formats are there? Currently, the formats XRechnung and ZUGFeRD are permitted according to the EU standard EN-16931.

11. How do I switch to e-invoicing? You should plan the introduction of e-invoicing in your company carefully. Consult your accounting software or ERP system provider for advice. Here's a checklist of the most important steps:

- Review current processes: You should first review your current invoicing processes. Which systems are used? What types of invoices are sent? Which data sources are used? Is an ERP system already in place? Can this system process e-invoices? If in doubt, seek external advice.

- Selecting the right software: Now you need to select a software solution that meets your e-invoicing requirements. It's important to consider compatibility with existing systems. Ideally, your accounting software or ERP system already includes a corresponding tool.

- Employee training: The introduction of e-invoicing requires employee training in the new processes. It is important that everyone involved learns how to use the new software and understands how e-invoices are processed.

- Test phase: Before the complete switchover, you should conduct a test phase to ensure that all systems are functioning smoothly and that e-invoices are being processed correctly.

12. What are the advantages of e-invoicing? Regardless of the fact that e-invoicing will become mandatory starting in 2025, it still makes sense to switch to e-invoicing. Here are some of the benefits of switching to electronic invoicing:

- Increased efficiency: Because e-invoices are machine-readable, they can be processed without manual intervention. This saves time and reduces the risk of errors. This significantly increases accounting efficiency.

- Cost savings: Companies save significant costs on printing, paper, postage, and storage. Archiving and storing electronic invoices is significantly easier. Furthermore, invoices can be processed and paid more quickly, improving cash flow.

- Transparency and security: E-invoices offer greater transparency and traceability because all data is structured and easily verifiable. Furthermore, e-invoices meet high security standards that ensure the protection of sensitive data.

- Sustainability: Switching to e-invoicing reduces paper consumption and thus protects the environment. The digitalization of processes is an important step toward sustainable corporate management.

13. How does e-invoicing work? E-invoicing works based on standardized electronic formats optimized for machine processing. Essentially, an e-invoice goes through the following steps:

- Creation: The invoice is created in a structured format (e.g., XML). This structure ensures that all relevant information, such as invoice number, invoice date, amounts, tax information, etc., is presented in a clearly defined format.

- Transmission: The invoice will be sent via electronic channels.

- Receiving and processing: The recipient can import the e-invoice directly into their accounting or ERP system. Since the data is machine-readable, processing is automatic and requires no manual intervention.

- Archiving: Like traditional invoices, electronic invoices must be archived for several years. However, this can be done entirely digitally, saving paper and storage costs when storing the e-invoice.

14. What legal requirements apply to e-invoicing? The legal requirements for e-invoicing are clearly defined and based on EU Directive 2014/55/EU and the German E-Invoicing Act. The most important points include:

- Formats: E-invoices must be presented in a structured, electronic format. ZUGFeRD and XRechnung are common formats in Germany.

- Transmission: Transmission must take place via secure channels that meet data protection and security requirements, e.g., via the PEPPOL network.

- Content: E-invoices must contain all legally required information, such as invoice number, date, tax rates, amounts, and clear identification of the invoice issuer and recipient.

- Retention obligation: E-invoices are also subject to statutory retention obligations, i.e. they must be archived in an audit-proof format.

15. What happens if I don't use e-invoicing? Companies that fail to use e-invoicing after January 1, 2025, risk legal consequences. Depending on the country and legislation, this could result in fines or the rejection of invoices and non-payment. E-invoicing is already mandatory for companies that do business with public contracting authorities. Failure to comply with the regulations could lead to exclusion from tenders. For invoicing to public contracting authorities, it is recommended to use XRechnung, as most public institutions work with this format.

16. Conclusion The mandatory e-invoicing requirement from 2025 represents a decisive step toward digitalization and process optimization in companies. Regardless of legal regulations, it helps your company process invoices more digitally, quickly, and cost-effectively. Transitional periods are in place for sending or issuing electronic invoices. However, starting January 1, 2025, all companies (except B2C) must be able to receive e-invoices. In the long term, e-invoicing will become the standard in business communication. Those who invest early will reap the benefits of a leaner and more efficient accounting system.

Here are the most important points in advance:

Here are the most important points in advance: