Get in touch

Arzu Torcuk

distribution

Phone: +49 7191 34 55 354

Mobile: +49 160 99538999

Email: arzu.torcuk@conesprit.de

The introduction of e-invoicing has been mandatory since 2025. With the formats XRechnung and ZUGFeRD Ensure legally compliant and efficient invoicing.

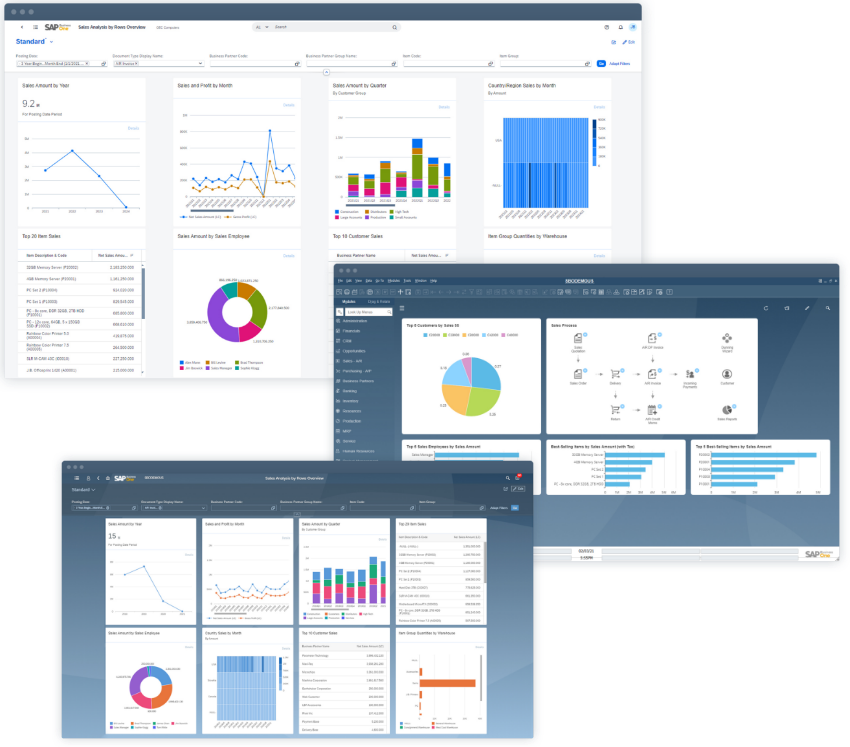

SAP Business One automated and simplifies your processes related to the creation, receipt and archiving of e-invoices.

This means for you: Legally compliant and faster processes, less administrative effort.

Furthermore, SAP Business One ensures that invoices are archived in a legally compliant manner for the long term.

Contact us – we'd be happy to advise you!

Free online viewer for e-invoices

Free online viewer for e-invoicesReceived an e-invoice but can't read it?

Our free e-invoice viewer displays electronic invoices like a PDF file – without any installation or registration.

How does it work?

Your obligations as an entrepreneur

Each Companies in Germany will need to be able to issue e-invoices in the future. to receive and processThis obligation applies in particular to:

To give companies time to make the change, the following Transitional periods set:

By the end of 2026:

By the end of 2027:

From 2028:

To meet legal requirements on time, you should adapt your invoicing processes in good time. This includes:

Review and adaptation of your IT and accounting systems

Training your employees on e-invoicing

Make your company ready for digital invoicing now and benefit from greater efficiency and less administrative effort!

Two formats have been established for electronic invoice exchange: XRechnung and ZUGFeRD. Both comply with the EU standard EN 16931 and enable automatic, seamless processing.

While XRechnung is mandatory for public contracting authorities in Germany, the use of ZUGFeRD remains voluntary in the B2B sector. Nevertheless, both formats are legally recognized and meet the legal requirements of the E-Invoicing Regulation.

Electronic invoices must be processed and archived digitally—a paper printout is not sufficient. Since formats such as XRechnung and ZUGFeRD are legally equivalent to paper invoices, they are subject to a ten-year retention period.

With SAP Business One, documents can be exported directly to SharePoint. If SharePoint is configured as an audit-proof repository, it meets all compliance requirements. Since the necessary licenses are usually already included in Microsoft 365, there are generally no additional costs – a particularly cost-effective solution.

This is how you ensure that your company complies with legal requirements while also operating efficiently.

Don't you believe it? Then try it now!

Since invoices automatically processed, the processing time is shortened.

Encrypted transmission and digital signatures protect from manipulation and unauthorized access.

Less manual work means faster processes and a lower error rate.

No expenses more for paper, printing and mailing.

Less paper consumption reduces the ecological footprint.

Complete documentation from creation to payment.

With SAP Business One

In order for the electronic invoicing process to function smoothly, companies must meet certain technical and legal requirements.

With SAP Business One You are perfectly prepared for this:

We make your company flexible, because our cloud solution is fast, secure and cost-effective.

With SAP Business One in the cloud, you save on expensive hardware and costly IT maintenance. Your data is always available – whether in the office, working from home, or on the go. Automatic updates ensure that your system is always up to date.

Whether you're a small team or a growing company, our cloud adapts to your needs. You get started quickly, only pay for what you actually use, and benefit from the highest level of security.

To make it easier for you to get started, we offer you a free cloud demo to.

Don't you believe it? Then get in touch now!