Get in touch

Arzu Torcuk

distribution

Phone: +49 7191 34 55 354

Mobile: +49 160 99538999

Email: arzu.torcuk@conesprit.de

The perfect Solution for small and medium-sized businesses.

As your partner for efficient and transparent financial management, we help you automate and digitize your accounting processes.

You can handle journal entries, tax calculations, and multi-currency transactions quickly and reliably. Payments, bank statements, and account reconciliations?

No problem – you always have complete control over your finances.

With DATEV export and DATEV import as well as integrated interfaces such as MAGPIE the collaboration with your tax advisor runs smoothly.

We're always by your side: from initial setup to optimal use. With us and SAP Business One, you get accounting that saves time, minimizes errors, and simplifies your processes.

Try it now for free in our demo version or get personal advice – for your next step in growth!

Automated accounting

Less effort for you, as recurring tasks such as bookings, tax calculations and account reconciliations are carried out automatically.

Maximum transparency

You can keep an eye on your liquidity and cash flow at all times thanks to central data management and up-to-date financial reports.

Simple control

Manage accounts, check invoices, or plan budgets – with SAP Business One, you can complete your accounting tasks intuitively and quickly.

Seamless integration

DATEV export and DATEV import as well as the ELSTER interface enable smooth collaboration with tax consultants and tax authorities.

International scalability

Whether national or international business – SAP Business One supports you with multiple currencies and tax regulations.

Networked business processes

Accounting, sales, purchasing, and warehouse management are integrated. This saves you time, reduces errors, and always has the right data at your fingertips.

With SAP Business One, your accounting becomes more efficient and less time-consuming. Automated processes such as postings, tax calculations, and account reconciliations reduce effort while maintaining a clear overview of your finances at all times.

Through seamless integration with DATEV and ELSTER, as well as support for international business processes, SAP Business One facilitates collaboration with tax advisors and tax authorities. Networked business processes also ensure you can work quickly and error-free.

All processes of your accounting are interconnected and automated – from planning to monitoring.

Thanks to the Controlling functions Always have an overview and control over your budget.

The system warns you if your budget is exceeded automatically.

Her banking transactions are all in one place – whether cash withdrawals or credit card payments.

Her Account balance is continuously updated and account reconciliation is carried out efficiently.

Bank statements can be processed semi-automatically.

With just a few clicks you can create Financial reports such as balance sheets, profit and loss statements, cash flow statements as well as profit and loss statements and SuSa.

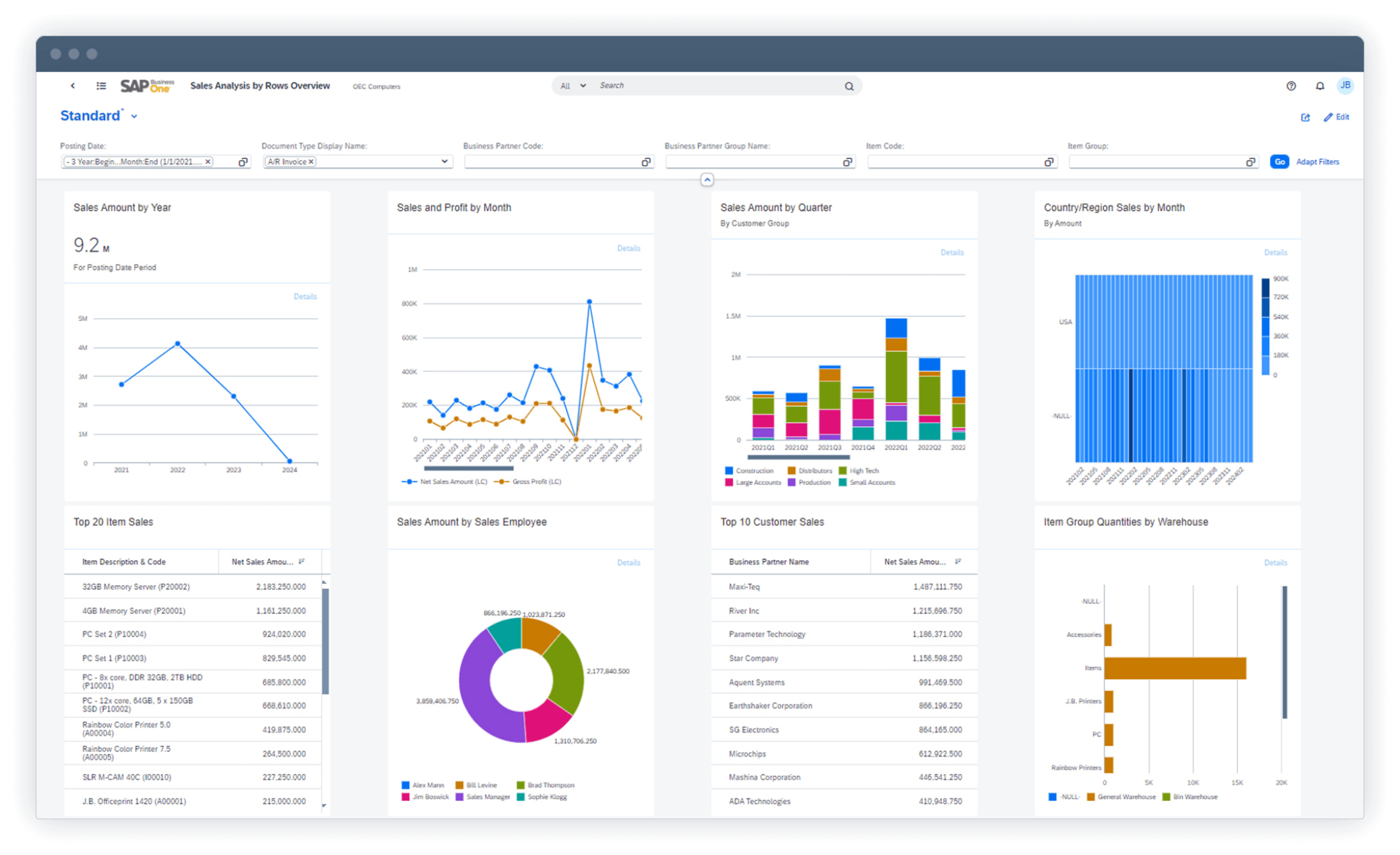

Detailed Sales analyses help you identify trends and make strategic decisions.

Data for the Recapitulative statements (REC) are reported in SAP Business One.

The OSS procedure (One-Stop-Shop) we can integrate into the system.

In the Chart of accounts manage all booking accounts.

You can standardized chart of accounts SKR03 and SKR04 or use an individual one.

Our system automatically creates Bookings for all relevant business transactions.

Thanks to our DATEV imports You can import payroll statements from your tax office directly into the system – even if your tax office does not work with DATEV.

Using predefined Regulate posting records are generated automatically.

At the same time, the corresponding Tax code automatically set to ensure correct tax treatment.

Create Templates for recurring bookings to save time and avoid errors.

Set regular Bookings such as rent payments, which are then carried out automatically.

Our system is similar Fluctuations in Exchange rates automatically This ensures that the balances of domestic and foreign currencies remain balanced.

You can create individual Financial reports such as additional profit and loss statements.

With Financial report templates create a customized Financial reporting, which adapts flexibly to the requirements of your company, your parent company or your branches.

Export booking data with the DATEV export and process them further in DATEV – or import posting batches with our app for DATEV import.

Send sales receipts and booked supplier invoices directly to DATEV Unternehmen Online.

Submit VAT advance returns thanks to our ELSTER extension electronically to the tax office.

Benefit from simplified tax audits through GoBD compliance: All data can be exported to GoBD/GDPdU.

You can manage multiple companies thanks to the Multi-tenancy administer.

With the Cost center accounting and project management, you can allocate costs precisely to different business areas – for example, functional areas, regions or projects.

Electronic Invoices You can create, send, receive and process invoices in the standardized X-invoice format.

The relevant Bookings You can send your annual financial statements directly to your tax advisor from the system.

The final Year-end closing entries Your tax advisor will then be imported back into the system.

Our app for Incoming invoice recognition automatically records, analyses and processes your incoming invoices.

Significantly simplified administration of fixed assets including automatic calculation of depreciation.

Our system automatically reminds you payments due, which makes dunning and receivables management much easier.

E-invoices: No PDFs!

E-invoices: No PDFs!

The E-invoice is that legally required Format in which invoices must be exchanged between companies (B2B) in the future. Since January 1, 2025, all invoices must be all Companies obliged to issue e-invoices received and read to be able to.

Depending on the size of your company, you will also be required to issue e-invoices from 2026 or 2027. create and to send.

You can find more information here.

Important: E-invoice stands for “electronic invoice“, but that means not PDFs or emails, but a very specific File format (XML). E-invoices are made by people unreadable and require a software.

SAP Business One offers a standard feature for receiving and creating legally compliant e-invoices. Both common formats XRechnung and ZUGFeRD are supported. Our software enables the easy creation of electronic invoices that comply with legal requirements.

Even if you don't book SAP Business One with us, you are welcome to use our free online viewer for e-invoices. This displays e-invoices just like a PDF invoice.

Use a free e-invoice viewerWe train you and your team practical and individually geared towards your processes.

We will adapt the training units to fit within your timeframe. Your work processes seamlessly integrated.

We'll take every step together with you and ensure that you and your team are safe and confident move within the system.

This is how SAP Business One becomes a time-saving and relieving Tool for your company.

SAP Business One is not just the digital core of your financial processes – it also offers integrated Interfacesthat enable data exchange with official financial systems Make it very easy.

This allows you to remain flexible and easily link different programs together.

DATEV export

With the DATEV export you can export all or selective booking data as Booking batch directly from SAP Business One to your tax advisor transmit.

In addition to the booking entries, customer and supplier master data as well as general ledger accounts created in SAP Business One are also transferred.

DATEV import

Thanks to our DATEV import, you can import your DATEV generated Booking batch directly back into SAP Business One import.

This allows you to transfer data from DATEV payroll accounting directly from DATEV to SAP Business One and post the payroll accounting directly in SAP Business One.

With the MAGPIEWith the SAP Business One interface, you can submit your advance VAT return electronically directly from the software – without any detours. ELSTER (Electronic Tax Return) ensures that your tax data is securely transmitted to the tax office.

Thanks to this interface, you can use the data stored in SAP Business One directly for your VAT return. just a few clicks send it online to the tax office – quickly and reliably. Additionally, you can create and print VAT reports at any time to keep track of everything.

With SAP Business One you also have Reporting-The perfect solution for your requirements. You want large Data volumes Quickly consolidate data or create financial reports in real time? You'll get exactly the right tools for it.

Thanks to built-in Analytics tools With SAP Business One and Power BI, you can consolidate large amounts of data from different departments, locations, and subsidiaries. At no additional cost or long wait times, you can analyze data, create interactive data stories, and share them securely within your team.

We make your company flexible, because our cloud solution is fast, secure and cost-effective.

With SAP Business One in the cloud, you save on expensive hardware and costly IT maintenance. Your data is always available – whether in the office, working from home, or on the go. Automatic updates ensure that your system is always up to date.

Whether you're a small team or a growing company, our cloud adapts to your needs. You get started quickly, only pay for what you actually use, and benefit from the highest level of security.

To make it easier for you to get started, we offer you a free cloud demo to.

Everything you need to know about e-invoicing.

Save time with incoming invoice recognition

How our DATEV Import App works

Don't you believe it?

Contact us now and we’ll prove it to you!